-

U.S. Dairy a Key Player to Meet Growing Global Demand

By USDEC Staff September 6, 2022- Tweet

-JPG.jpeg?width=147&name=Capture%20(002)-JPG.jpeg) U.S. dairy exports’ strong performance continued in the first half of 2022, following the record-breaking volume and value growth last year. Exports year-to-date are up 27% in value and 2% in volume compared to the same period last year, buoyed by a healing supply chain. In fact, the United States was the only major dairy exporter to see solid growth in exports over the past 12 months (July 2021-June 2022), reinforcing its advantages as the international supplier of choice for dairy products and ingredients.

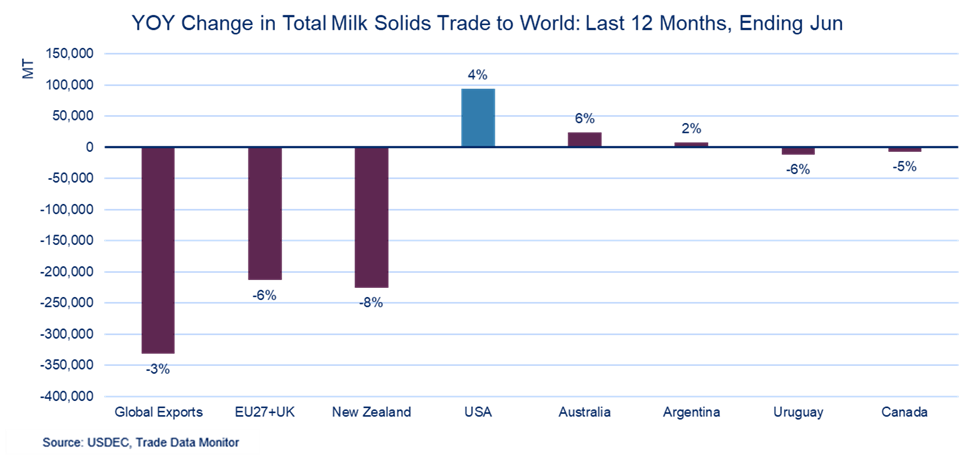

U.S. dairy exports’ strong performance continued in the first half of 2022, following the record-breaking volume and value growth last year. Exports year-to-date are up 27% in value and 2% in volume compared to the same period last year, buoyed by a healing supply chain. In fact, the United States was the only major dairy exporter to see solid growth in exports over the past 12 months (July 2021-June 2022), reinforcing its advantages as the international supplier of choice for dairy products and ingredients.

Despite a global pullback in dairy trade of 3%, U.S. export volume grew 4% over the last 12 months, while the other major exporters, New Zealand and the EU27+United Kingdom saw declines of 8% and 6%, respectively. Australia and Argentina were the only other larger exporters to see growth, but on smaller volumes than the United States. With global dairy demand expected to continue to grow in the back half of 2022, the U.S. is well-positioned to continue providing high-quality dairy products to global customers as other major exporters struggle to keep pace with the growing demand.

Confident in the Face of Uncertainty

Despite the increased macroeconomic uncertainty this year, shipments continue to move with June posting strong growth across many products, building on positive export momentum. The strong June numbers were driven in part by ongoing growth in cheese exports, which grew by 31% year-over-year in June. Exports were equally impressive across other major products, with whey product exports increasing by 23% and lactose exports rising by 22%. Skim milk powder (SMP) was the only major product that saw strong declines in June driven primarily by the continued absence of China from the global market.Year-to-date (January-June) U.S. export highlights include:

- Cheese: Exports increased 17%, reaching 229,751 MT and on pace to surpass the previous annual record

- Lactose: Exports grew 12%, reaching 220,992 MT

- Whey Ingredients: Exports up 1%, reaching 321,797 MT

- Milk Protein Concentrate: Exports rose 3%, reaching 21,695 MT

- Skim Milk Powder: Exports down 8%, but were nearly 20,000 MT higher than 2020

- Butterfat: Exports climbed 43%, reaching 38,107 MT

A Key Player for the Remainder of 2022 and Beyond

This positive export growth for U.S. Dairy is expected to continue. While U.S. milk production has not seen strong growth over the past year along with other major exporters, the challenges to growth in the U.S. are largely temporary while other major exporters like New Zealand and the EU are facing both temporary challenges as well as are more structural obstacles to milk production growth. As those temporary challenges abate for both the U.S. and others, the structural challenges (increased environmental regulation, water use regulations, etc.) faced by New Zealand and the EU will continue to limit their production growth while the more favorable production environment in the U.S. allows for a return to strong milk production growth moving forward. This ensures high-quality, U.S. milk is available for processing into delicious, nutritious and functional dairy products and ingredients, which is key to fueling exports in the second half of 2022 and beyond.

The U.S. herd is showing signs of growth after the dramatic contraction in 2021 which was largely driven by high costs of inputs and labor shortages. U.S. dairy farmers produce more milk per cow, and more components per liter of milk – such as butterfat, protein, and other skimmed solids – compared to any other country, thanks to impressive technological innovations, improvements in genetics and enhancements in feed rations.

As global demand increases, and major exporters including the EU and New Zealand continue to face structural limitations such as climate, land and water resources and feed input costs, U.S. Dairy is ideally positioned to be able to supply high quality, sustainable dairy products and ingredients on a competitive and consistent basis.

Visit ThinkUSAdairy.org and follow our LinkedIn business page for further information on U.S. Dairy and inspiration for innovation.

Most Popular Posts

Find by Date, Geography and Dairy Product

- September 2015 (6)

- December 2015 (5)

- September 2016 (5)

- December 2016 (5)

- June 2017 (5)

- February 2015 (4)

- March 2015 (4)

- April 2015 (4)

- May 2015 (4)

- June 2015 (4)

- July 2015 (4)

- November 2015 (4)

- January 2016 (4)

- March 2016 (4)

- June 2016 (4)

- August 2016 (4)

- October 2016 (4)

- November 2016 (4)

- February 2017 (4)

- March 2017 (4)

- April 2017 (4)

- November 2013 (3)

- October 2015 (3)

- February 2016 (3)

- April 2016 (3)

- May 2016 (3)

- July 2016 (3)

- January 2017 (3)

- May 2017 (3)

- July 2017 (3)

- August 2017 (3)

- September 2017 (3)

- October 2014 (2)

- August 2015 (2)

- October 2017 (2)

- December 2017 (2)

- July 2020 (2)

- December 2013 (1)

- February 2014 (1)

- June 2014 (1)

- August 2014 (1)

- September 2014 (1)

- November 2014 (1)

- November 2017 (1)

- January 2018 (1)

- February 2018 (1)

- May 2018 (1)

- June 2018 (1)

- July 2018 (1)

- August 2018 (1)

- September 2018 (1)

- October 2018 (1)

- November 2018 (1)

- February 2019 (1)

- March 2019 (1)

- April 2019 (1)

- July 2019 (1)

- October 2019 (1)

- March 2020 (1)

- April 2020 (1)

- June 2020 (1)

- October 2020 (1)

- November 2020 (1)

- March 2021 (1)

- April 2021 (1)

- June 2021 (1)

- August 2021 (1)

- February 2022 (1)

- June 2022 (1)

- September 2022 (1)

- October 2022 (1)

- November 2022 (1)

- February 2023 (1)

- April 2023 (1)

- USDEC Staff (65)

- Kara McDonald (24)

- Terri Rexroat (15)

- John Klees (15)

- Kristi Saitama (9)

- Angelique Hollister (8)

- Vikki Nicholson-West (8)

- Shannon Koski (8)

- Rohit Kapoor (3)

- Keith Meyer (2)

- Moises Torres-Gonzalez (2)

- Amy Foor (2)

- Alan Levitt (1)

- Tom Vilsack, President and CEO (1)

- Allison Guzman (1)

- Dacia Whitsett-Morrow (1)

- Ryan Hopkin (1)

- Matthew Pikosky (1)

- Ross Christieson (1)

- Nina Halal (1)

- Mary Wilcox (1)

Keywords

- 2018 beverage trends (3)

- 2018 Food Innovations (1)

- 2018 food trends (3)

- Asia (1)

- Avian Influenza (1)

- Award-winning cheeses (3)

- Awards (2)

- Back-to-School (1)

- Baked Goods (1)

- Bakery (1)

- Beer (2)

- Beverage (5)

- Breakfast (1)

- Butter (6)

- Casein (2)

- Cheese (48)

- cheese flavors (2)

- Cheese Pairing (3)

- Cheesemaking (5)

- Child Nutrition (3)

- China (6)

- Clean Label (6)

- Common Food Names (1)

- Consistent Supply (3)

- Consumer Insights (48)

- Consumer Promotional Tools (1)

- Consumer Trends (15)

- Contest (1)

- craft foods (2)

- Cultured dairy (1)

- Dairy (17)

- Dairy Detective (4)

- Dairy Fat (1)

- Dairy Futures and Options (3)

- Dairy Ingredients (82)

- Dairy Ingredients Symposium (1)

- Dairy Permeate (1)

- Dairy Product Solids (1)

- Dairy Production (5)

- Dairy Proteins (35)

- Dairy Resources (23)

- Dairy Trade (1)

- Dairy Trends (10)

- Dessert (1)

- Digestive Health (2)

- Donna Berry (1)

- Drinkable yogurt (1)

- Early Childhood Development (1)

- Educational Tools (1)

- Egg Replacement (2)

- Egg Substitution (1)

- Egypt (1)

- Energy (4)

- Environment (2)

- Europe (1)

- Export Data (8)

- Exports (7)

- Farming (1)

- Flavor Trends (1)

- Follow-on Formula (1)

- Food Aid (2)

- Food and Beverage Trends (7)

- Food Production (3)

- Food Technology (3)

- Foodservice (2)

- Free From Claims (1)

- Full-fat Dairy (1)

- Geographical Indications (GIs) (1)

- GHG (1)

- Global (74)

- Global Dairy Market (2)

- Global Demand (2)

- Global Market (4)

- Global Supply (1)

- Greek Yogurt (1)

- Gulfood (2)

- Gut Health (1)

- Health (1)

- Healthy Aging (8)

- Healthy Indulgence (1)

- Heavy Cream (1)

- High Quality Protein (11)

- Holiday Dessert (2)

- Holidays (1)

- IFT (7)

- IFT2016 (1)

- IFT2018 (2)

- Infant Formula (1)

- Infographic (3)

- Innova Market Insights (4)

- Innovation (2)

- Japan (7)

- Lactose (8)

- Lactose-free (1)

- LinkedIn (1)

- Malnutrition (2)

- Market Insights (67)

- Methane (1)

- Mexico (2)

- Micellar Casein (3)

- Middle East (2)

- Middle East/North Africa (9)

- Milk (8)

- Milk Permeate (2)

- Milk Powder (10)

- Milk Protein (19)

- Milkfat (5)

- Millennials (3)

- MPC (4)

- MPI (1)

- Muscle Maintenance (1)

- Muscle Recovery (2)

- Muscle Synthesis (2)

- NAFTA (1)

- New Product Introductions (1)

- New Year's Resolutions (1)

- Nonfat Dry Milk/Skim Milk Powder (4)

- Nutrition (21)

- Nutrition Research (14)

- Obesity (1)

- Overnutrition (1)

- Permeate (19)

- Price Volatility (2)

- Probiotics (2)

- Product Innovation (3)

- Protein (33)

- Prototypes (1)

- Record (3)

- Reduced-Fat (1)

- Research & Data (1)

- Resources and Tools (8)

- Risk Management (3)

- RTD Coffee and Tea (1)

- Salon Culinaire (1)

- Salt Substitute (1)

- Savory Flavors (1)

- Science and Research (3)

- Service Providers (1)

- Simple Ingredients (1)

- Singapore (1)

- Skimmed Milk Powder (2)

- Smoothies (1)

- Snack Trends (3)

- Snacking (4)

- Snacks (1)

- Sodium (3)

- Sodium Reduction (4)

- South Korea (3)

- Southeast Asia (9)

- Sports Nutrition (4)

- Stewardship (1)

- Student Competition (1)

- Supplier Directory (1)

- Supply (4)

- Sustainability (7)

- Sustainability Awards (1)

- Sustainable Nutrition (7)

- Technology (1)

- ThinkUSAdairy (2)

- Toddler Formula (1)

- Trade Data (1)

- U.S. Dairy Industry (11)

- U.S. Dairy Industry Growth (6)

- U.S. Dairy Partnerships (4)

- U.S. Dairy Products (15)

- UK (1)

- United Arab Emirates (5)

- United States (10)

- USDEC Events (44)

- Value (3)

- Vietnam (5)

- Volatility (1)

- Volume (4)

- Waste Reduction (1)

- Weight Management (6)

- Whey (14)

- Whey Ingredients (3)

- Whey Permeate (5)

- Whey Products (3)

- Whey Protein (47)

- Whey Protein Concentrate (3)

- Whey Protein Isolate (5)

- Whole-milk dairy (1)

- Wine (2)

- World Championship Cheese Contest (1)

- World Cheese Awards (2)

- World Milk Day (1)

- WPC (4)

- WPI (1)

- Yogurt (6)